The Invention of (and Fallout From) the 30-Year Mortgage

- Nick Rossolillo

- Feb 24, 2016

- 5 min read

Updated: Nov 5, 2020

“Some debts are fun when you are acquiring them, but none are fun when you set about retiring them.” – Ogden Nash

The year was 1934. The United States was wallowing through the Great Depression. Unemployment was well into the double digits, nearly one in ten homes were in foreclosure, and the average property had lost about half its value from peaks seen in the 1920’s. That year would see the launch of the Federal Housing Administration, or FHA, one of many measures to help pull the country out of its deep rut.

The economic crisis of the 1930’s would end up being a grand experiment in government intervention, and would give birth to the modern home loan that we are familiar with today. Yet the onset of these financial instruments have had far-reaching consequences, both intended and unintended, and is worth mulling over. What can we learn from history, and how do we put that knowledge to work for our personal financial situations?

The Invention of the 30 Year Mortgage

The FHA was created to help Americans get back into or keep their home, as well as stimulate construction. Many home owners were unable to negotiate terms with lenders during the depression, in part because of widespread unemployment and a lack of liquidity for banks. New standards of lending were needed to get things moving again.

Prior to the onset of the Great Depression in 1929, home mortgages were very different from what they are now. A typical mortgage had an average six-year term, had a variable rate that was typically re-negotiated every year, and the loan was usually limited to a maximum of 50% of the property value. As a result, more than half of Americans rented in the pre-WWII era. Home ownership was the exception, not the rule.

When the FHA program got under way, mortgage terms and conditions were drastically altered. Duration of the loan was extended to the now familiar and commonplace 30-year term, rates were offered at fixed interest rather than variable, and the loan amount was increased to well over 50% of the property value. The government-backed program met with great success, and was expanded post WWII when war veteran’s compensation packages started to include the new home loan terms.

These new long-dated, fixed rate, high loan-to-value mortgages successfully stabilized the housing market and helped many Americans fulfill their dream of home ownership (by the 2000’s, homeownership had grown from less than 40% of households owning their own home prior to the Great Depression to well over 60% of all households owning their own home).

Despite those successes, there have been both financial and psychological repercussions from the loose lending practices launched over 70 years ago. What have those repercussions been?

A History of US Real Estate Since the 1930’s

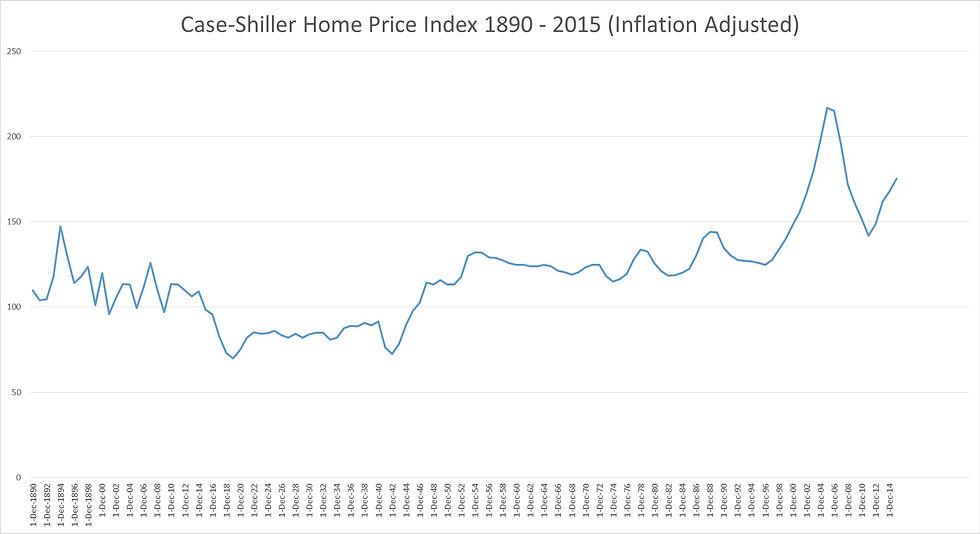

Let’s take a look at a few charts illustrating how real estate has reacted since the implementation of FHA standards.

Data courtesy of Robert Shiller, Standard and Poor’s, and the US Census Bureau. Charts created by Nicholas Rossolillo.

Let’s start with the first chart, the Case-Shiller home price index. Home values are indexed to 1890 property sales prices, and account for inflation rates (basically meaning that inflation is subtracted out, and we are left with property values in today’s dollar figures). Chart number two illustrates the ratio between home values and total household income. The historical average has been roughly 2.2 (stated another way, a home value is 2.2 times your annual pay), but that ratio starts to rise rapidly starting in the late 1980’s and now hovers around 3.5. Chart three compares the Case-Shiller index from chart one with inflation and population growth (notice the uncorrelated price of real estate compared with steady population growth, but the inverse relationship property has with inflation and interest rates).

What do we learn? You can see in the charts the depressed values of real estate through the 1930’s. As new lending standards got under way in the late 30’s and through World War II, real estate makes a sudden and dramatic jump up. As that period gives way to rising interest rates and eventually high inflation, real estate stagnates for a roughly 30 year period. Inflation and interest rates started a steady downtrend in the 80’s, and combined with another round of slow easing of lending practices, we see property values run up again very quickly through 2006. As seen in chart two, the spike in property value as a ratio to income is also concerning, as that ratio remains well above the historical average even post-2008 financial crisis.

Chart three shows that, despite what many people believe, real estate is uncorrelated with population growth (more people does not always translate into an increase in demand, which in turn does not always lead to an increase in price). Instead, inflation and interest rates paired with current lending practices are a much more useful proxy for home values. It is also concerning that current home values remain at historic highs when factoring in inflation and the average family pay check.

Real Estate and Your Financial Plan

For anyone looking to purchase a home, remaining cautious would be the course of wisdom. Buying a home is big decision. For most Americans, a home purchase likely means a purchase of their largest asset. That asset purchase can have far-reaching and long-lasting consequences. Keep in mind that, despite what many claim, real estate values do not ALWAYS go up. Sometimes the stay flat. Sometime they go down. Sometimes they go down and stay down for a very long time. The above charts demonstrate this fact.

Here are a few tips for home buyers:

Purchasing a home is not an investment, it is the purchase of a commodity (a roof over your head). What is your long-term plan? Is this home an acceptable place to put down roots? What is the plan if you do have to move and you are not able to sell (the assumption that property values will be higher someday is not good enough)?

What are your financial priorities, and what do you prefer to spend money on? Is it your place of residence, your car, travel, shopping, starting a family, etc.? For most of us, money is a limited resource. We cannot have it all, and therefore money should be prioritized and allocated according to what we deem most important in life. Are you spending your money on things that are truly important to you? In other words, do you have a budget?

Beware of taking on too much house. Just because a lender (be it through a government subsidized program or otherwise) may be willing to lend you as much as 40-50% monthly debt payment to your gross monthly income does not mean you should take on that much of a payment. Living well within your means, if possible, is always the best course of action. If you decide to buy, how low can you realistically get your mortgage payment as a percentage of your income? I typically recommend that your mortgage payment for your primary residence be no more than 25% of monthly income.

Mortgage lending has undergone massive change in the US in the last 70 years, and that change has drastically altered the outlook many have on real estate and housing. A little historical and mathematical perspective can go a long way and can help us avoid the irrational decision making when it comes to home ownership that has ruined so many over the last decade.

Comments